Vancouver sports radio host Matthew Sekeres tweeted out an interesting lead today:

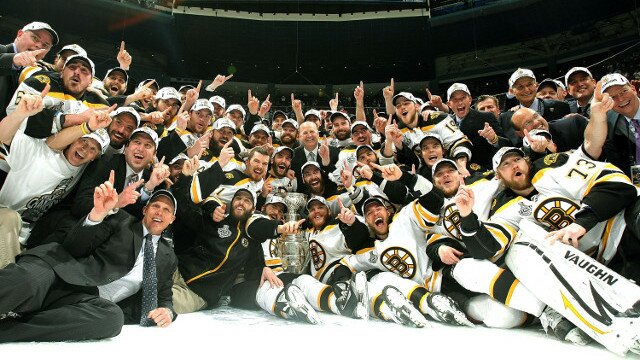

“Am told by 2 NHL sources that #Bruins owner Jeremy Jacobs forced employees to pay tax on 2011 Stanley Cup rings. About $7K per ring. Some support staff couldn’t afford the tax up front, so players stepped up and covered the cost so they could get rings too.”

Denver Post reporter Adrian Dater checked out the local angle by contacting members of the 2001 Stanley Cup champion Avalanche team (which, of course, included Bruins legend Ray Bourque) and added on his Twitter that the players he spoke to said they didn’t pay taxes on their rings, nor did any Avalanche employees they know.

This question of rings being taxed or not comes at a funny time because of the recent humongous Powerball jackpot that was reportedly won by two different people. Lottery winnings are taxable, so before the lucky winners can start planning what to do with their money, they’ll need to lob off the amount that their state will want (which varies) as well as what the IRS will want.

This also became an issue last summer during the Olympics when rumors spread that American gold medalists would have to pay $9,000 in taxes for their winnings. This issue is actually more complex than the rumors would have it sound–along with the hardware, medalists get cash disbursed by the U.S. Olympic Committee, whereas the medals are awarded by the International Olympic Committee. Countries’ independent Olympic committees often hand out big money for a job well done on the international stage and, just like the lotto winnings, they will be taxed.

However, that $9,000 figure seems farfetched, as Snopes.com revealed when looking into the issue. Snopes takes into consideration the income bracket of the person who won the medal. The $9,000 comes from the assumption that the winner is in the 35 percent tax rate income bracket, which is for people who make more than $388,350 a year. Some athletes may also be able to write off the winnings against what it took to get those winnings, but their mileage may vary.

Plus, that $9,000 figure is based on presuming that the athletes are paying based on the value of the very metals from which the medals are crafted. Prices fluctuate for gold, silver and bronze, but since gold medals are about one percent gold–the rest is silver and copper–and CBS News estimated a gold medal’s value at $644.

Still, the $9,000 rumor caused Republican senator Marco Rubio of Florida to introduce a bill that would make Olympic medals and cash prizes tax-exempt. It hasn’t passed or become law to my knowledge, though Republicans in the House of Representatives introduced similar bills around the same time.

Taxing championship rings in pro sports isn’t something Jacobs made up in 2011, though. The issue has been discussed at least as long ago as 1985, when Sports Illustrated tackled the topic [emphasis mine]:

“Other leagues have different policies. The NFL partially underwrites the cost of rings, reimbursing owners about $2,400 for each one, while the NHL leaves the matter entirely up to its owners. The NBA standardized its title ring from 1969 through 1983. Today the winning team selects its own design, with the league paying the tab.”

Jostens, the same company that handles class and sports rings for high schools and other non-pro leagues across the country, designed the Bruins ring, just as they have done for many Stanley Cup rings since 1978. (Interestingly, that doesn’t include the 2001 Avalanche.) There aren’t any price tags included for those rings on their website.

So, as far as I can tell from doing some research into the matter, here’s the deal:

- NHL owners can do what they want with regards to awarding championship rings

- As a gift or a bonus, rings are taxable, like Olympic winnings and lotto winnings

- However, the amount people will pay in taxes on these things varies depending on income

It is entirely possible that, at least for some members of the Bruins organization, their tax bill for their ring came to $7,000. However, based on Snopes’ findings related to income brackets, it may not be that way for everyone. The extra tax burden imposed on lower-income members of the organization like support staff may have been an outlier on their taxes last year, but I am not sure it came out to an extra $7k. If I am wrong and it did, then at least the players in the organization are a little kinder than their owner. The only method of verification would be to see the tax returns for different people in different income brackets who all received rings in order to compare and contrast the dollar amounts paid, but that seems like a bit much to ask.

Snopes ended up ruling the $9,000 rumor partially true. That sounds like a fairly reasonable outcome. There are many other valid reasons for hockey fans to not be fond of Jacobs, but this doesn’t seem like it’s as simple as what Sekeres said it was.

Share

Share